Our Events

See Individual Events Below

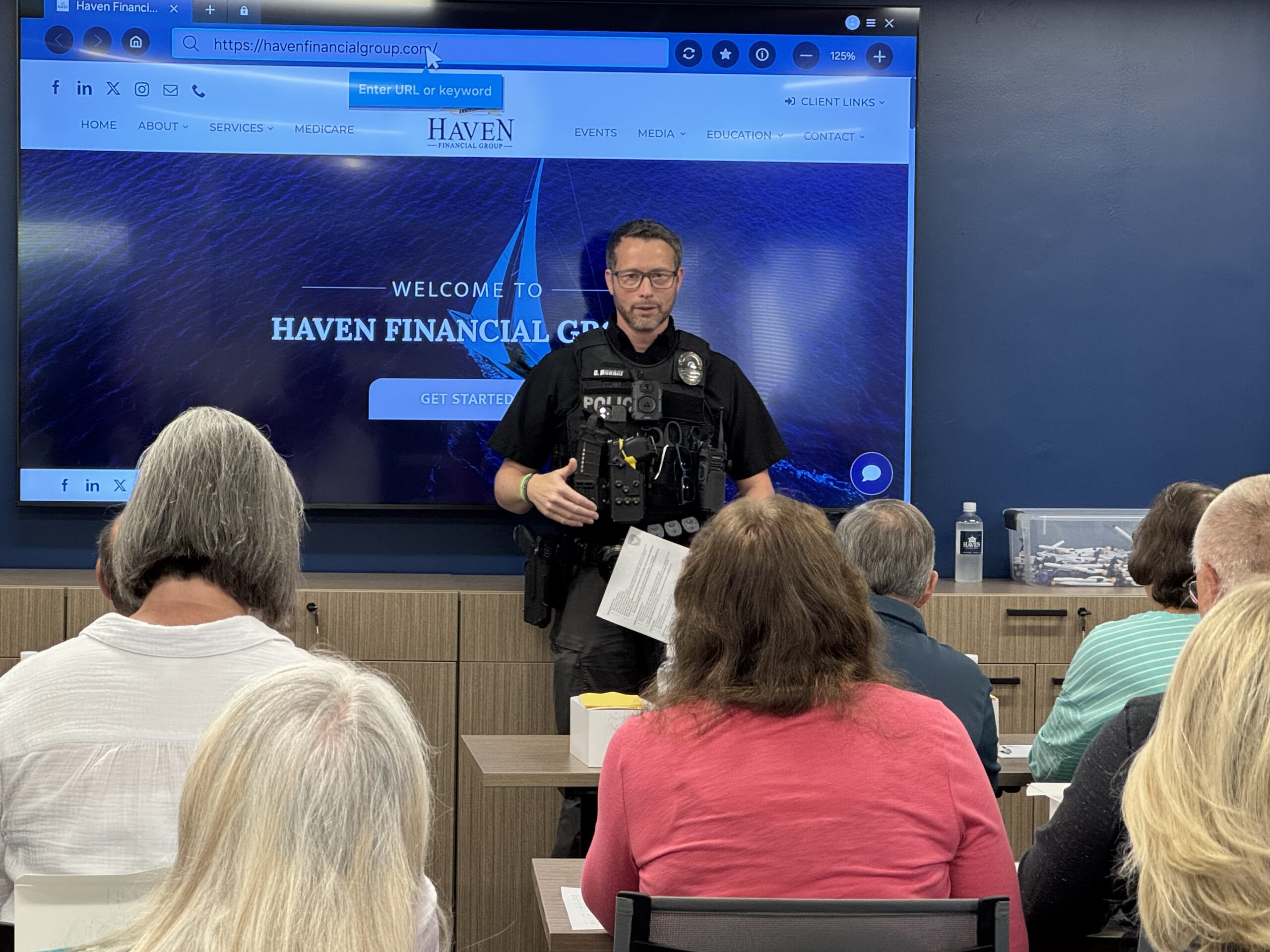

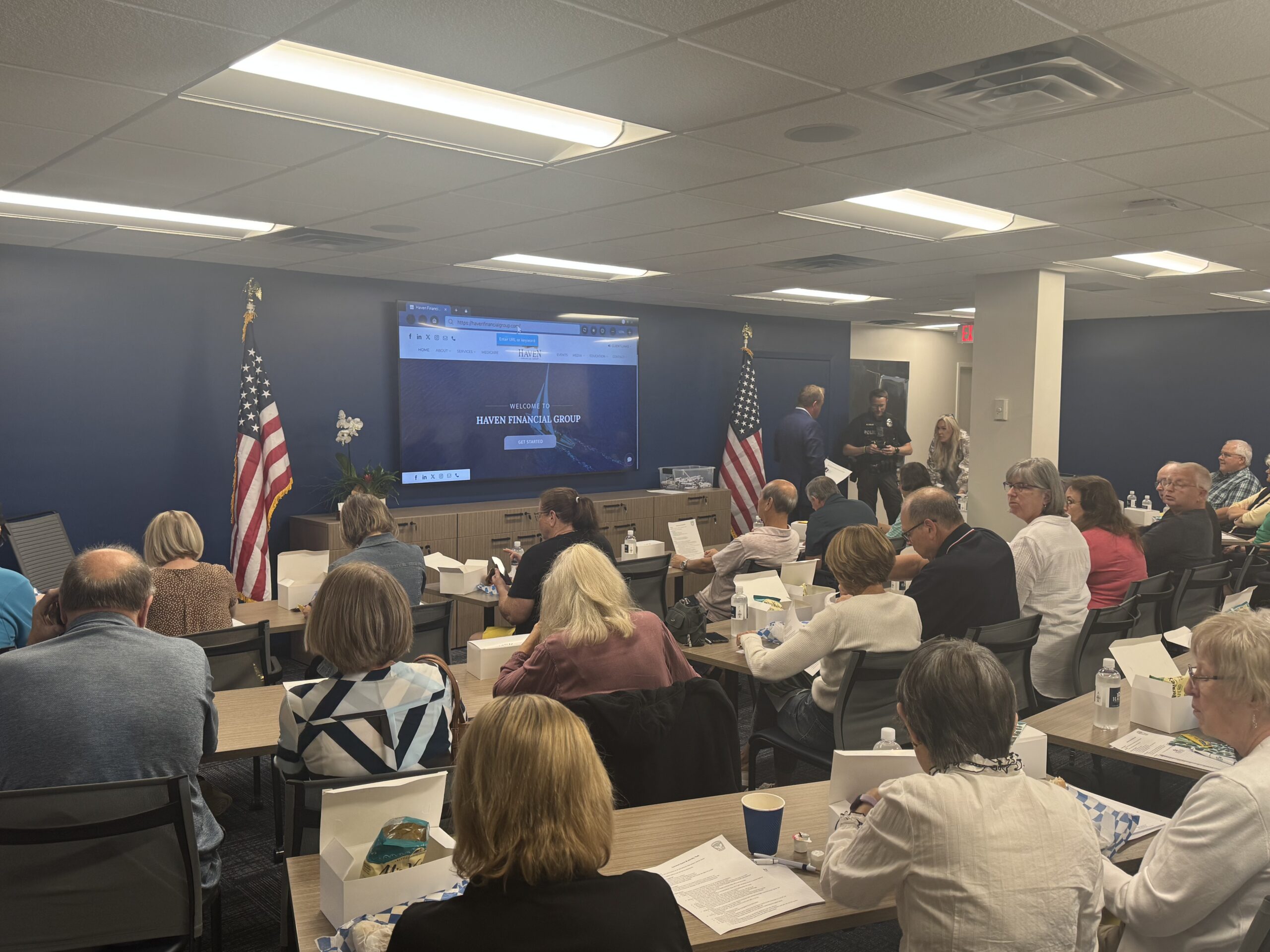

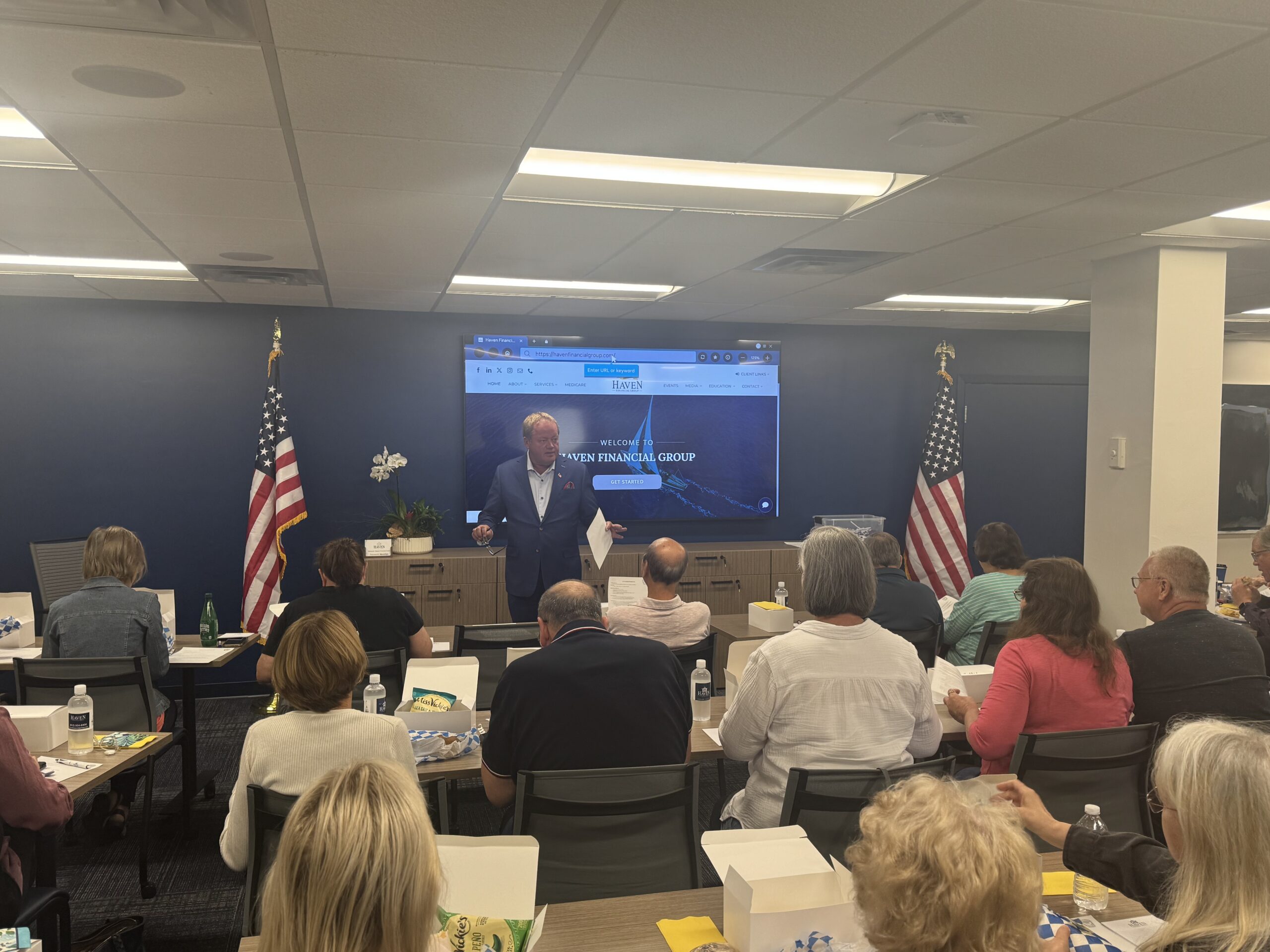

Financial Workshops

Hosted by Haven Financial Group, our workshops are offered complimentary to our community. Stay informed about our specialty services and learn more about retirement options by joining us at one of our financial workshops. Call today or click on a date below to get started in reserving your seat for one of our upcoming events.

Workshops

Events in February–March 2026

March 2, 2026 (1 event)

March 2, 2026Location:

Heritage Library

20085 Heritage Dr

Lakeville, MN 55044

Details:

For many Americans, Social Security is the single largest asset they have in retirement, and greater than 90% of all recipients do not maximize their Social Security benefits. Advance planning is essential and the decisions you make today can have a tremendous impact on the total amount of benefits you stand to receive over your lifetime.This educational workshop will provide you with much needed information to help you understand the system, coordinate spousal and survivor benefits, minimize taxes, and maximize your personal benefits.

Whether you’re single, married, divorced, or widowed, there may be ways to maximize the lifetime Social Security benefits you receive.

One of the most important decisions you need to make before you retire is when and how to claim Social Security benefits. About half of retirees apply for Social Security as soon as they become eligible at age 62, but by doing so, they may significantly and permanently impact their income and benefits for the rest of their lives. The difference between the best and worst possible decision of when to start Social Security can be well over $100,000!

REGISTER HERE

March 3, 2026 (2 events)

March 3, 2026Location:

Inver Glen Library

8098 Blaine Ave E

Inver Grove Heights, MN 55076

Details:

For many Americans, Social Security is the single largest asset they have in retirement, and greater than 90% of all recipients do not maximize their Social Security benefits. Advance planning is essential and the decisions you make today can have a tremendous impact on the total amount of benefits you stand to receive over your lifetime.This educational workshop will provide you with much needed information to help you understand the system, coordinate spousal and survivor benefits, minimize taxes, and maximize your personal benefits.

Whether you’re single, married, divorced, or widowed, there may be ways to maximize the lifetime Social Security benefits you receive.

One of the most important decisions you need to make before you retire is when and how to claim Social Security benefits. About half of retirees apply for Social Security as soon as they become eligible at age 62, but by doing so, they may significantly and permanently impact their income and benefits for the rest of their lives. The difference between the best and worst possible decision of when to start Social Security can be well over $100,000!

REGISTER HERE

March 3, 2026Location:

Prior Lake Library

16210 Eagle Creek Avenue SE

Prior Lake, MN 55372Details:

For many Americans, Social Security is the single largest asset they have in retirement, and greater than 90% of all recipients do not maximize their Social Security benefits. Advance planning is essential and the decisions you make today can have a tremendous impact on the total amount of benefits you stand to receive over your lifetime.This educational workshop will provide you with much needed information to help you understand the system, coordinate spousal and survivor benefits, minimize taxes, and maximize your personal benefits.

Whether you’re single, married, divorced, or widowed, there may be ways to maximize the lifetime Social Security benefits you receive.

One of the most important decisions you need to make before you retire is when and how to claim Social Security benefits. About half of retirees apply for Social Security as soon as they become eligible at age 62, but by doing so, they may significantly and permanently impact their income and benefits for the rest of their lives. The difference between the best and worst possible decision of when to start Social Security can be well over $100,000!

REGISTER HERE

March 9, 2026 (1 event)

March 9, 2026Location:

Prior Lake Library

16210 Eagle Creek Avenue SE

Prior Lake, MN 55372Details:

For many Americans, Social Security is the single largest asset they have in retirement, and greater than 90% of all recipients do not maximize their Social Security benefits. Advance planning is essential and the decisions you make today can have a tremendous impact on the total amount of benefits you stand to receive over your lifetime.This educational workshop will provide you with much needed information to help you understand the system, coordinate spousal and survivor benefits, minimize taxes, and maximize your personal benefits.

Whether you’re single, married, divorced, or widowed, there may be ways to maximize the lifetime Social Security benefits you receive.

One of the most important decisions you need to make before you retire is when and how to claim Social Security benefits. About half of retirees apply for Social Security as soon as they become eligible at age 62, but by doing so, they may significantly and permanently impact their income and benefits for the rest of their lives. The difference between the best and worst possible decision of when to start Social Security can be well over $100,000!

REGISTER HERE

March 12, 2026 (1 event)

March 12, 2026Location:

Heritage Library

20085 Heritage Dr

Lakeville, MN 55044

Details:

For many Americans, Social Security is the single largest asset they have in retirement, and greater than 90% of all recipients do not maximize their Social Security benefits. Advance planning is essential and the decisions you make today can have a tremendous impact on the total amount of benefits you stand to receive over your lifetime.This educational workshop will provide you with much needed information to help you understand the system, coordinate spousal and survivor benefits, minimize taxes, and maximize your personal benefits.

Whether you’re single, married, divorced, or widowed, there may be ways to maximize the lifetime Social Security benefits you receive.

One of the most important decisions you need to make before you retire is when and how to claim Social Security benefits. About half of retirees apply for Social Security as soon as they become eligible at age 62, but by doing so, they may significantly and permanently impact their income and benefits for the rest of their lives. The difference between the best and worst possible decision of when to start Social Security can be well over $100,000!

REGISTER HERE

March 24, 2026 (1 event)

March 24, 2026Location:

Savage Library - MLKSL0324

13090 Alabama Ave

Savage, MN 55378

Details:

For many Americans, Social Security is the single largest asset they have in retirement, and greater than 90% of all recipients do not maximize their Social Security benefits. Advance planning is essential and the decisions you make today can have a tremendous impact on the total amount of benefits you stand to receive over your lifetime.This educational workshop will provide you with much needed information to help you understand the system, coordinate spousal and survivor benefits, minimize taxes, and maximize your personal benefits.

Whether you’re single, married, divorced, or widowed, there may be ways to maximize the lifetime Social Security benefits you receive.

One of the most important decisions you need to make before you retire is when and how to claim Social Security benefits. About half of retirees apply for Social Security as soon as they become eligible at age 62, but by doing so, they may significantly and permanently impact their income and benefits for the rest of their lives. The difference between the best and worst possible decision of when to start Social Security can be well over $100,000!

REGISTER HERE

March 25, 2026 (1 event)

March 25, 2026Location:

Savage Library - MLKSL0324

13090 Alabama Ave

Savage, MN 55378

Details:

For many Americans, Social Security is the single largest asset they have in retirement, and greater than 90% of all recipients do not maximize their Social Security benefits. Advance planning is essential and the decisions you make today can have a tremendous impact on the total amount of benefits you stand to receive over your lifetime.This educational workshop will provide you with much needed information to help you understand the system, coordinate spousal and survivor benefits, minimize taxes, and maximize your personal benefits.

Whether you’re single, married, divorced, or widowed, there may be ways to maximize the lifetime Social Security benefits you receive.

One of the most important decisions you need to make before you retire is when and how to claim Social Security benefits. About half of retirees apply for Social Security as soon as they become eligible at age 62, but by doing so, they may significantly and permanently impact their income and benefits for the rest of their lives. The difference between the best and worst possible decision of when to start Social Security can be well over $100,000!

REGISTER HERE

March 26, 2026 (1 event)

March 26, 2026Location:

Galaxie Library 14955

Galaxie Ave Apple Valley,

MN 55124

6:00 PMDetails:

For many Americans, Social Security is the single largest asset they have in retirement, and greater than 90% of all recipients do not maximize their Social Security benefits. Advance planning is essential and the decisions you make today can have a tremendous impact on the total amount of benefits you stand to receive over your lifetime.This educational workshop will provide you with much needed information to help you understand the system, coordinate spousal and survivor benefits, minimize taxes, and maximize your personal benefits.

Whether you’re single, married, divorced, or widowed, there may be ways to maximize the lifetime Social Security benefits you receive.

One of the most important decisions you need to make before you retire is when and how to claim Social Security benefits. About half of retirees apply for Social Security as soon as they become eligible at age 62, but by doing so, they may significantly and permanently impact their income and benefits for the rest of their lives. The difference between the best and worst possible decision of when to start Social Security can be well over $100,000!

REGISTER HERE

March 31, 2026 (1 event)

March 31, 2026Location:

Galaxie Library 14955

Galaxie Ave Apple Valley,

MN 55124

6:00 PMDetails:

For many Americans, Social Security is the single largest asset they have in retirement, and greater than 90% of all recipients do not maximize their Social Security benefits. Advance planning is essential and the decisions you make today can have a tremendous impact on the total amount of benefits you stand to receive over your lifetime.This educational workshop will provide you with much needed information to help you understand the system, coordinate spousal and survivor benefits, minimize taxes, and maximize your personal benefits.

Whether you’re single, married, divorced, or widowed, there may be ways to maximize the lifetime Social Security benefits you receive.

One of the most important decisions you need to make before you retire is when and how to claim Social Security benefits. About half of retirees apply for Social Security as soon as they become eligible at age 62, but by doing so, they may significantly and permanently impact their income and benefits for the rest of their lives. The difference between the best and worst possible decision of when to start Social Security can be well over $100,000!

REGISTER HERE

Webinars

No New Webinars At This Time